About South American Beverage Companies

Posted on January 12, 2023 (Last modified on January 14, 2023) 2 min read • 313 words

Recently, I’ve been curious to find out what products are available in South American supermarkets. In particular, I’m looking into soft drinks and beer.

Coca-Cola FEMSA

- Website: https://www.coca-colafemsa.com

- Dividend history

- Related materials

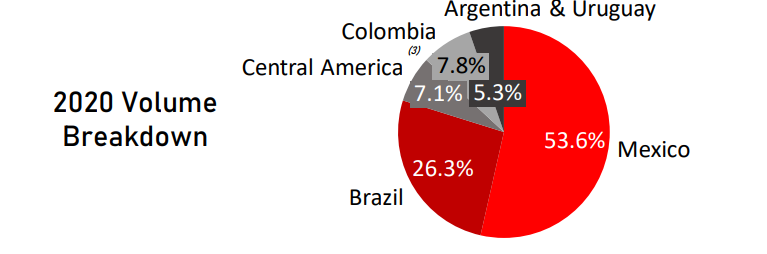

Coca-Cola FEMSA, known as $KOF, is a Mexican beverage company headquartered in Mexico City, Mexico. The company manufactures and distributes Coca-Cola beverages primarily in Latin America, including Mexico, Central America, Colombia, Venezuela, and Brazil. It regularly acquires regional beverage suppliers; in 2018, it acquired a supplier in Guatemala and Uruguay.

Currently, Mexico and Brazil account for almost 80% of the total volume. Therefore, it is important for the company to be able to grow in Mexico and Brazil.

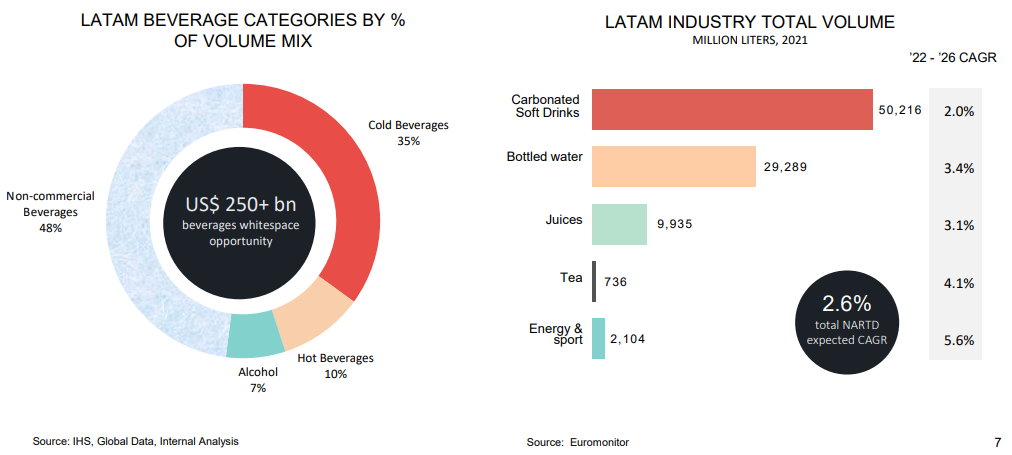

The types of beverages sold fall into the four major categories shown below.

- Carbonated soft Drinks

- Non-Carbonated Soft Drinks

- Energy and Sports

- Bottled Water

And KOF has the leading market share in Carbonated Soft Drinks and Non-Carbonated Soft Drinks in Mexico.

Compañía Cervecerías Unidas S.A.

Website: https://www.ccu.cl/

Yahoo finance: [https://finance.yahoo.com/quote/CCU?p=CCU:title]

Related materials

- [1] EDGAR

- [2] Financial Reports

- [3] FORM 20-F

- [4] Corporate-Presentation-CCU_3Q22

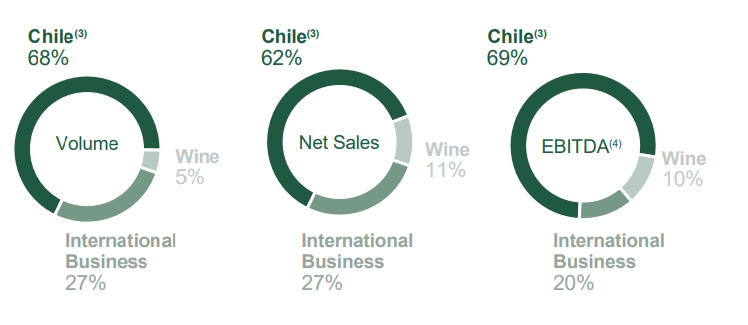

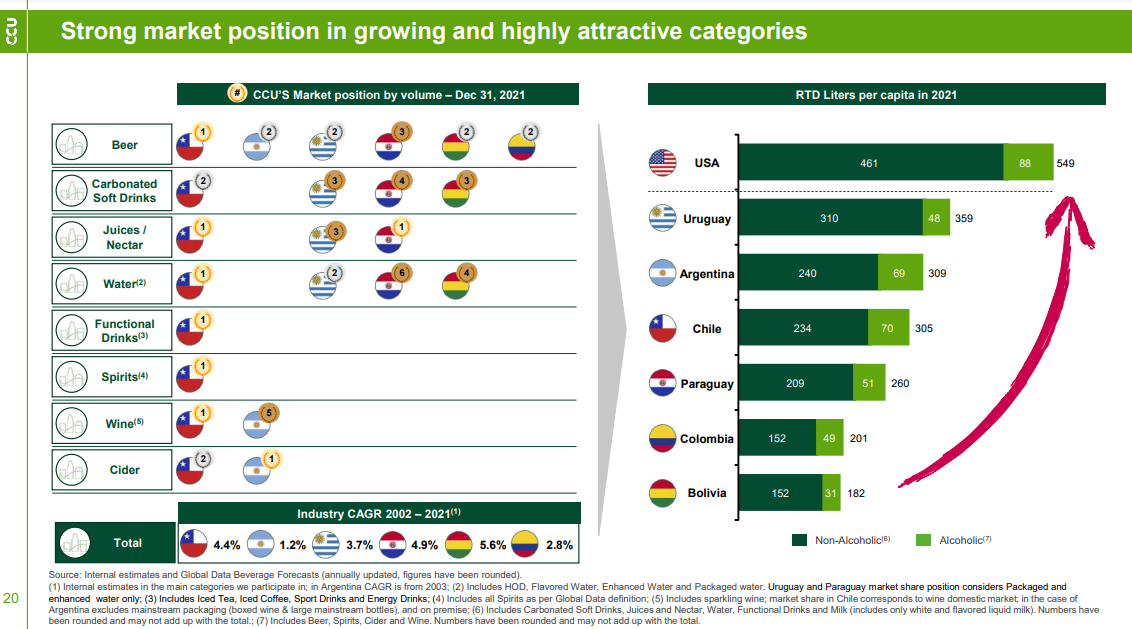

$CCU is a Chilean producer of diversified beverages. Originally based in Chile, the company expanded beyond Chile to Uruguay, Paraguay, Bolivia, and Colombia during the 2010s. The sales are composed as follows:

- Chile business segment 60% of sales

- International business segment (including Argentina, Bolivia, Paraguay and Uruguay) 27.3%

- Wine business segment, including domestic market and exports in Chile and Argentina, 10.0%

The average annual growth rate (GDP) of the Chilean economy between 2010 and 2021 is about 3.3%. It should be noted that this is positive but not necessarily very high.

I like coffee and butterflies.